The U.S. e-cigarette market size is expected to grow from USD 30.33 billion in 2023 to USD 57.68 billion in 2028, registering a CAGR of 13.72% during the forecast period (2023-2028). For the World Health Organization, smokers are at a greater risk of being affected by COVID-19 than non-smokers. Additionally, a study conducted by Guyana University showed that nearly 56.4% of the U.S. youth population reported a change in their use of e-cigarettes at the start of the pandemic. In addition, one-third of young people quit smoking and another third reduced their use of e-cigarettes. The remaining young people either increased their use or switched to other nicotine or cannabis products, thus reducing e-cigarette sales on the market. With the high popularity of e-cigarettes among the young population and the rapid expansion of e-cigarette stores across the country, the penetration rate of e-cigarettes in the United States is very high. People are increasingly using e-cigarettes or electronic nicotine delivery systems (ENDS) as an alternative to smoking traditional cigarettes or for recreational purposes. The e-cigarette market has witnessed significant growth over the past decade due to the growing focus on traditional tobacco cigarettes. E-cigarettes were introduced as an alternative to traditional cigarettes. The knowledge that e-cigarettes are safer than traditional cigarettes is expected to further drive market growth, especially among the younger generation, owing to different studies conducted by medical institutions and associations. In 2021, the World Health Organization reported that tobacco causes more than 8 million deaths every year. More than 7 million of the above-mentioned deaths were caused by direct smoking, while 1.2 million among non-smokers died from second-hand smoke. The country has the largest e-cigarette sales network. However, new tax rules on e-cigarettes across states in the country will act as a potential threat to market growth during the forecast period.

Rising health concerns among smokers drive the market

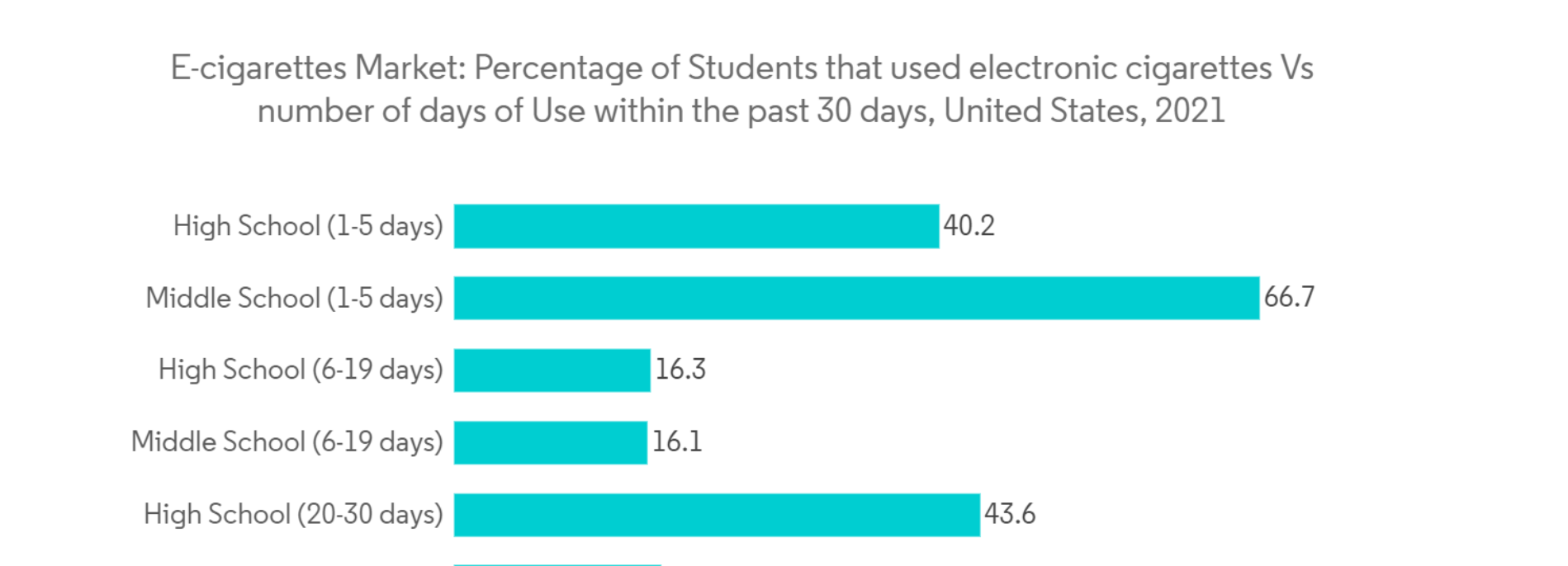

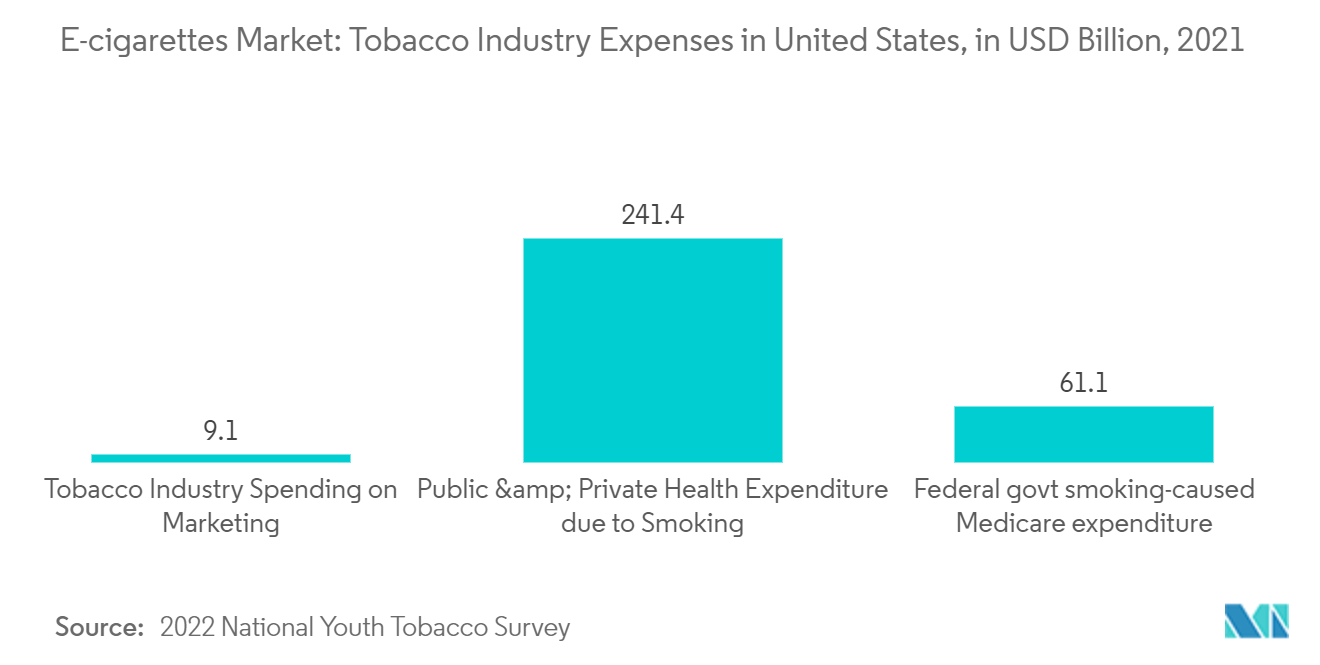

The increase in tobacco-related cancer cases in the United States, with the majority of cases related to smoking, has led the public to seek alternatives or alternatives to quit smoking. Smoking-related health problems have increased dramatically over the past few years as many governments and individual organizations prioritize this issue. Additionally, smoking is associated with a higher risk of dementia and cognitive impairment in older adults. It may also be associated with an increased risk of hearing changes, cataracts, reduced abilities, and macular degeneration. E-cigarette use is also on the rise because these devices do not use tobacco. A majority of the U.S. population is considering e-cigarettes as a way to quit smoking, while some of the smoking population are turning to e-cigarettes as an alternative to smoking. Additionally, since these products are available in nicotine and non-nicotine forms, individuals consider them based on their own preferences. For example, in October 2022, a study conducted by the U.S. Food and Drug Administration and the U.S. Centers for Disease Control and Prevention (CDC) found that 2.55 million middle and high school students in the United States reported using electronic devices during the one-month study period. cigarette. This accounts for 3.3% of middle school students and 14.1% of high school students. More than half of these young people (more than 85%) use disposable flavored e-cigarettes.

High sales growth in offline retail channels of vape

Sales of e-cigarettes through offline retail channels, including e-cigarette stores, are prominent in the country. People prefer to purchase different varieties of e-cigarettes through offline channels, which allow them to choose from different models and brands available in the market. Customers prefer to buy from vape shops as they can get many different varieties of products to choose from and also get to know about the features of the product. In addition, e-cigarette stores prepare the liquid mixture used in e-cigarettes according to customer needs and preferences, which adds convenience to the purchasing process. Furthermore, government acceptance of e-cigarettes has further led to marketing of the products through offline modes, thereby increasing the customer base. For example, in 2021, the U.S. Food and Drug Administration allowed the sale of some appropriate vaping products to protect public health.

High sales growth in offline retail channels

Sales of e-cigarettes through offline retail channels, including e-cigarette stores, are prominent in the country. People prefer to purchase different varieties of e-cigarettes through offline channels, which allow them to choose from different models and brands available in the market. Customers prefer to buy from vape shops as they can get many different varieties of products to choose from and also get to know about the features of the product. In addition, e-cigarette stores prepare the liquid mixture used in e-cigarettes according to customer needs and preferences, which adds convenience to the purchasing process. Furthermore, government acceptance of e-cigarettes has further led to marketing of the products through offline modes, thereby increasing the customer base. For example, in 2021, the U.S. Food and Drug Administration allowed the sale of some appropriate vaping products to protect public health.

Overview of the U.S. e-cigarette industry

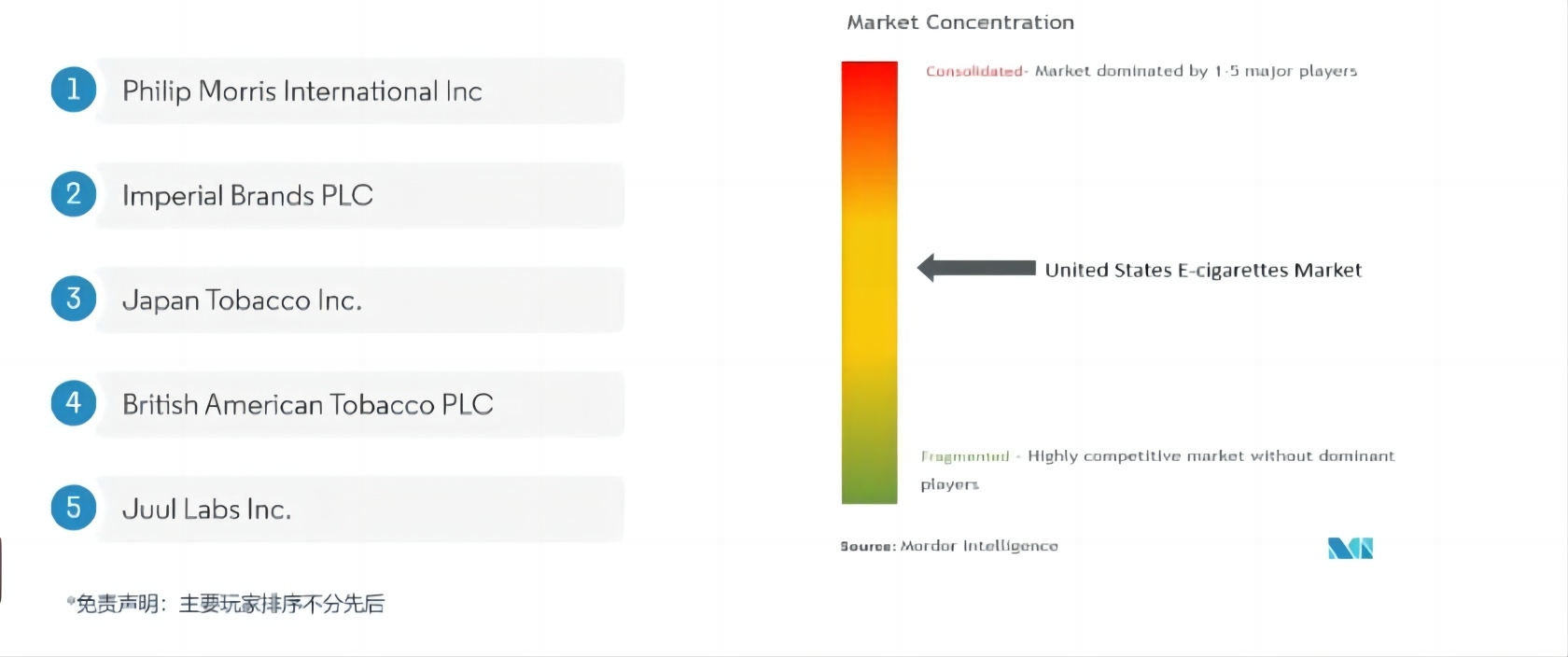

The U.S. e-cigarette market is highly competitive due to many large players. The market is consolidated with major players and caters to a large portion of the market. Major players such as Philip Morris International Inc., Imperial Brands Inc., Japan Tobacco Plc, British American Tobacco Plc and Juul Labs Inc. adopt different strategies to mark their position in the market. The main strategies adopted by these companies include product innovation and mergers and acquisitions. Due to the changing preferences of customers, major players have come up with new product developments. These companies also prefer partnerships and acquisitions, which help them expand their presence across geographies and product portfolios.

US e-cigarette market news

November 2022: An RJ Reynolds Tobacco Company patent for composite tobacco-containing materials shows that tobacco can reportedly be consumed in a smokeless form. Using smokeless tobacco products typically involves placing processed tobacco or tobacco-containing formulations into the user's mouth.

November 2022: Philip Morris claims it has acquired 93% of Swedish Match as part of a plan to enter the US market with less harmful cigarettes. Philip Morris plans to use Swedish Match's U.S. sales force to promote nicotine pouches, heated tobacco products and eventually e-cigarettes to compete with its former partners Altria Group, Reynolds American and Juul Labs.

June 2022: Japan Tobacco’s device patent application is published online. The core of the concept is to create a smoking system with a flavored inhaler so that users can inhale flavors and other flavors without actually burning anything. For example, a flavor inhaler has a chamber containing a flavor-generating object and a heater for heating the flavor-generating object in the chamber.

Post time: Jan-13-2024